2025 Beauty Industry E-Commerce Market Statistics & Trends

2025 beauty industry e-commerce market statistics and global trends reveal digital growth, consumer shifts, and strategies shaping online cosmetics, skincare, and personal care sales.

Call Us (814) 637-3099

Call Us (814) 637-3099

Call Us (814) 637-3099

Call Us (814) 637-3099

2025 beauty industry e-commerce market statistics and global trends reveal digital growth, consumer shifts, and strategies shaping online cosmetics, skincare, and personal care sales.

Head Of Operations - Digital Web Solutions

The beauty industry is experiencing extraordinary growth in the e-commerce market, and this has changed how consumers find beauty products, research, and shop smartly. In 2025, understanding the comprehensive beauty industry e-commerce market statistics and emerging trends shaping this dynamic beauty market becomes crucial for beauty brands, retailers, and industry professionals looking to capitalize on this expanding beauty market.

The transformation of shopping from physical brick and mortar stores to online e-commerce market has changed consumer behavior, brand strategies, and market dynamics. According to the U.S. Census Bureau, e-commerce sales increased to $300.2 billion in the first quarter of 2025, with beauty products being a notable contributor to this growth. This comprehensive analysis explores the latest beauty industry e-commerce market statistics, regional growth, consumer insights, and technological innovations shaping this global beauty industry.

Global ecommerce stats 2025 reveal worldwide online shopping has surpassed trillions, with double-digit growth continuing across industries and regions globally.

Beauty e-commerce encompasses the online sales of cosmetics, skincare, haircare, fragrance, and personal care products through various digital channels, including brand websites, online marketplaces, mobile applications, and social media platforms. This digital transformation has democratized access to beauty products globally, allowing beauty consumers to explore international beauty brands, niche beauty items, and specialized formulations that were previously unavailable in their local markets.

The importance of beauty e-commerce extends beyond mere convenience for online shopping. It represents a fundamental shift in how beauty brands connect with beauty consumers, build communities, and deliver personalized experiences. Unlike traditional brick and mortar stores, online beauty shopping enables beauty brands to leverage advanced technologies such as augmented reality, artificial intelligence, and data analytics to create immersive, personalized shopping experiences that drive customer engagement and loyalty.

Moreover, Harvard Business Review shows that customers who engage with brands across multiple channels have a 30% higher lifetime value compared to single-channel customers, highlighting the immense potential of omnichannel beauty e-commerce strategies.

The global beauty market presents compelling opportunities for beauty brands and retailers worldwide. Current beauty industry e-commerce market statistics reveal accelerating growth patterns across all major regions, with digital transformation reshaping how beauty consumers discover and purchase beauty products through online beauty channels.

The global beauty market transformation reflects how beauty brands adapt to evolving consumer behavior patterns. Online beauty platforms now serve as primary touchpoints where beauty consumers discover new beauty products and research personal care solutions. This shift toward digital sales channels demonstrates significant growth potential across all beauty sectors.

The numbers speak volumes about the beauty industry’s digital momentum. The global beauty market is valued at USD 639.5 billion in 2025, with online beauty sales representing USD 257.5 billion—marking a 3.4% year-over-year increase. This substantial figure demonstrates how e-commerce has become integral to the beauty market’s overall health.

Worldwide, e-commerce drives 7.3% value growth for the beauty industry, according to NIQ research. This growth rate significantly outpaces traditional retail channels, highlighting the significant growth potential within digital sales. The beauty sector continues to benefit from increased online shopping adoption, particularly among younger consumers who prioritize convenience and digital experiences.

Beauty shoppers increasingly turn to online marketplaces for convenience and product variety. The beauty industry benefits from this digital transformation as e-commerce sales continue outpacing traditional brick and mortar stores performance across global beauty sales metrics.

Ecommerce conversion rates vary across industries, influenced by product type, pricing, user experience, and trust signals that impact consumer buying behavior online.

The trajectory of online beauty sales tells a compelling story of transformation. From 2015’s modest 14% online penetration to 26% in 2024, the beauty industry has witnessed unprecedented digital sales growth. Analysts forecast that online beauty will capture 33% of total beauty sales by 2030.

This progression reflects changing consumer behavior patterns and the beauty industry’s adaptation to digital-first strategies. The beauty market expects a 5% compound annual growth rate through 2030, powered by social-first content creation and augmented reality tools. Beauty brands investing in e-commerce capabilities position themselves for sustained, significant growth in this evolving landscape.

According to Statista, the worldwide Beauty & Personal Care industry is estimated to generate USD 677 billion in revenue by the year 2025. Its growth rate in the market is estimated to increase at the rate of 3.37% every year (CAGR 2025-2030). The biggest share in this market is Personal Care, and it is projected to have a market volume of US$293 billion by 2025. In addition, online sales are expected to increase by 38.4 percent of total revenue in the Beauty & Personal Care market in 2025.

Leading beauty products companies invest heavily in augmented reality technologies and social media platforms integration. These innovations help beauty brands connect with younger consumers who prioritize digital experiences when shopping for beauty items and personal care products.

According to entrepreneurship stats, early-stage entrepreneurial activity increased globally, reflecting stronger ecosystems and growing opportunities for innovative business ideas.

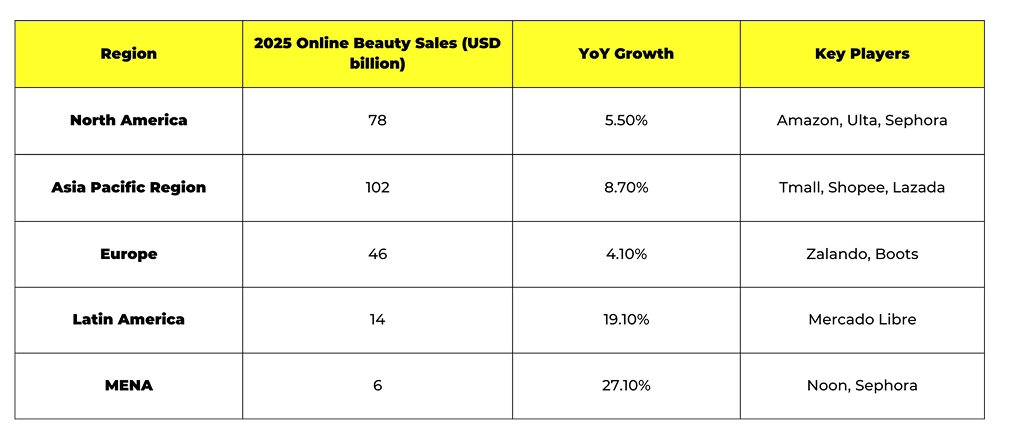

The global beauty market exhibits regional variations, reflecting diverse consumer preferences, economic conditions, and digital infrastructure development. Understanding these regional dynamics is essential for beauty brands planning international expansion or optimizing their market strategies across different beauty sectors.

Regional variations in the beauty industry e-commerce reveal fascinating market dynamics:

The Asia Pacific region leads in absolute online beauty revenue, with online penetration already surpassing 40% of total beauty and personal care spending. This region’s dominance reflects both market size and consumer adoption of digital sales channels.

E-commerce sales momentum varies significantly across regions, with emerging markets showing the highest growth rates. Latin America and MENA regions post double-digit growth, indicating massive opportunities for beauty brands expanding their online beauty presence. These markets demonstrate how digital sales are gaining traction among beauty shoppers worldwide.

North America maintains steady commerce sales growth, while Europe shows consistent but moderate expansion. The beauty industry in established markets focuses on optimizing existing e-commerce channels rather than pure expansion, leading to improved conversion rates and customer lifetime value.

The beauty sector demonstrates remarkable resilience as online customers embrace digital sales channels. E-commerce growth gaining traction across emerging markets reflects changing consumer behavior patterns and increased access to global beauty industry products.

Global e-commerce leaders include Amazon, Sephora, Tmall, Shopee, and TikTok Shop. Each leading beauty products company leverages marketplace scale, first-party data, and augmented reality features to boost online sales. These platforms serve as crucial distribution channels for beauty brands seeking to reach online customers effectively.

Amazon dominates the North American beauty and personal care market, while Asian platforms like Tmall and Shopee excel in their respective regions. The rise of social commerce platforms like TikTok Shop demonstrates how social media platforms are becoming integral to beauty industry e-commerce strategies.

Amazon statistics highlight how marketplace scale and advanced logistics give the platform a competitive edge in global beauty product distribution.

Mobile devices account for 59% of all digital sales checkouts in the beauty sector, according to Seller Rocket. Remarkably, 48% of beauty consumers purchase via smartphone every time they shop online beauty products. This mobile-first approach reflects changing consumer behavior patterns and the importance of mobile optimization for beauty brands.

The prevalence of mobile online shopping influences how beauty shoppers discover and evaluate beauty products. Social media integration, augmented reality try-on features, and streamlined checkout processes become crucial for capturing mobile commerce sales.

Behavioral targeting enables brands to track purchase patterns, ensuring personalized product recommendations drive repeat online beauty purchases.

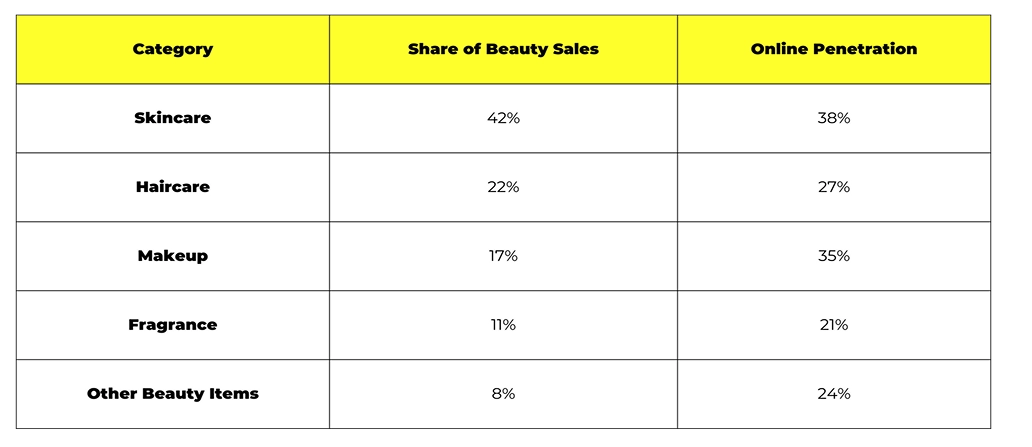

Understanding the fundamental metrics driving beauty e-commerce success helps beauty brands make informed decisions about product positioning, platform selection, and marketing strategies. These key beauty industry e-commerce market statistics reveal important patterns in consumer preferences and shopping behaviors across the beauty sector.

Understanding category performance helps beauty brands optimize their e-commerce strategies:

Skincare dominates the beauty market with the highest share of beauty sales, while makeup shows strong online beauty penetration rates. These statistics guide beauty brands in allocating resources across different beauty product categories and online shopping channels.

Smartphones drive nearly three-quarters of e-commerce sales in the beauty industry. This mobile dominance reshapes how beauty brands approach digital sales strategies. Mobile-optimized websites, apps, and social commerce integration become essential for capturing beauty shoppers’ attention and converting them into beauty consumers.

The shift toward mobile online shopping impacts everything from website design to payment processing. Beauty brands must prioritize mobile user experience to maximize commerce sales and remain competitive in the beauty sector.

Platform preferences reveal where beauty shoppers spend their time and money:

These platforms serve as crucial touchpoints for beauty brands seeking to expand their online beauty presence. The diversity of successful platforms demonstrates that beauty consumers value choice and convenience in their online shopping experiences.

Social media’s influence on beauty industry e-commerce cannot be overstated. According to NIQ research, social feeds now influence 68% of global online beauty purchases, making social media platforms essential for beauty brands’ marketing strategies. This integration of social content and e-commerce creates new opportunities for influencer marketing and user-generated content.

The rise of social commerce represents a fundamental shift in how beauty shoppers discover and purchase beauty products. Beauty brands must develop cohesive social strategies that drive both engagement and commerce sales.

Social media platforms revolutionize how beauty consumers discover cosmetic products and develop their skincare routine preferences. Influencer marketing strategies on these platforms drive significant growth in online beauty sales while building authentic connections with beauty shoppers.

Beauty and personal care face unique e-commerce challenges:

These metrics highlight optimization opportunities for beauty brands operating online beauty stores. Reducing cart abandonment and improving conversion rates directly impact commerce sales and overall beauty market performance.

Beauty shoppers today demonstrate distinct purchasing patterns that differ markedly from traditional retail behaviors. Understanding these evolving consumer preferences helps beauty brands create more targeted and effective e-commerce strategies across the beauty sector.

Beauty shoppers prioritize speed, value, personalized discovery, and friction-free returns when choosing online beauty channels. These factors drive consumer behavior patterns and influence how beauty brands structure their e-commerce experiences.

Understanding these motivations helps beauty brands optimize their online shopping platforms to better serve beauty consumers. The emphasis on personalization aligns with the beauty industry’s broader trend toward customized beauty products and skincare routine recommendations.

According to McKinsey & Company, Gen Z represents 40% of beauty consumers worldwide, and their mobile-first mindset accelerates digital sales growth. These younger consumers embrace online beauty shopping as their primary discovery and purchase method, driving innovation in e-commerce technologies and social media platforms integration.

The beauty industry must adapt to these generational preferences by investing in augmented reality features, social commerce capabilities, and mobile-optimized experiences. Beauty brands that successfully engage Gen Z and millennial beauty shoppers position themselves for sustained, significant growth.

Customer loyalty remains strong in the beauty sector, with 42% of people loyal to their favorite beauty brands—an increase of 10% year-over-year. This loyalty translates into repeat online sales and higher customer lifetime value for beauty brands investing in relationship building.

The subscription beauty market shows remarkable growth, expanding at 24% CAGR to reach USD 1.55 billion in 2025. Subscription services provide beauty brands with predictable revenue streams while offering beauty consumers curated beauty products and personal care items.

Influencer marketing significantly impacts the beauty industry e-commerce, with 63% of beauty shoppers purchasing products recommended by trusted creators, according to Phyllo API. TikTok influencers prove particularly effective, being 80% more likely to drive purchases than other channels.

This influence extends beyond traditional advertising to authentic user-generated content. Beauty brands leveraging influencer marketing strategies see improved online sales and stronger connections with beauty consumers across various social media platforms.

While brick and mortar stores remain important for tactile product testing, 43% of US beauty market spend now occurs online. Two-thirds of beauty shoppers switch fluidly between channels, exemplifying “research online, buy anywhere” behavior.

This hybrid approach requires beauty brands to create seamless omnichannel experiences. Online beauty platforms must complement brick and mortar stores rather than compete with them, providing beauty consumers with flexible shopping options that match their preferences.

The beauty sector continues to evolve rapidly, driven by technological advances, changing consumer values, and global connectivity. These emerging trends are reshaping how beauty brands approach digital commerce and customer engagement across the global beauty industry.

The beauty industry in 2025 reaches a critical tipping point where e-commerce defines go-to-market strategies. Continuous significant growth in e-commerce sales, driven by augmented reality technology, social discovery, and mobile convenience, means beauty brands mastering data analytics, customer loyalty, and cross-border logistics will outperform competitors.

Whether competing as an established leading beauty products company or an emerging disruptor, aligning product assortments, content strategies, and fulfillment capabilities with digital sales expectations of beauty shoppers becomes non-negotiable. The beauty market rewards brands that embrace online beauty innovations while maintaining strong connections with beauty consumers.

The statistics presented demonstrate that e-commerce will continue driving beauty industry growth throughout 2025 and beyond. Beauty brands investing in digital sales capabilities, augmented reality experiences, and social media platforms integration position themselves for sustained success in this rapidly evolving beauty sector.

Success in online beauty requires understanding consumer behavior, optimizing online shopping experiences, and leveraging influencer marketing effectively. Beauty brands that master these elements will thrive in the competitive beauty market landscape, capturing significant growth opportunities and building lasting relationships with beauty consumers.

The beauty industry’s online beauty channels grow approximately 5%-7% annually worldwide, with the Asia Pacific region and emerging markets exceeding 8% growth rates. This significant growth outpaces traditional retail channels and drives overall beauty market expansion.

The Asia Pacific region leads in absolute online beauty revenue, while Latin America and MENA regions post the fastest percentage growth rates. North America maintains steady commerce sales growth, and Europe shows consistent digital sales expansion across the beauty and personal care sector.

Combining augmented reality try-on experiences, personalized email marketing, and influencer marketing on video-first social media platforms delivers the strongest ROI for beauty brands. Social commerce integration and user-generated content also drive significant growth in online sales.

Mobile optimization is critical for beauty industry success, as mobile devices drive nearly three-quarters of e-commerce sales in online beauty. Conversion rates can double on mobile-optimized pages, making mobile experience essential for beauty brands targeting beauty shoppers.

The beauty industry e-commerce market faces intense competition, rising advertising costs, counterfeit beauty products, and rapidly changing algorithm rules on social media platforms. Beauty brands must invest in proactive compliance and brand protection strategies to succeed in online beauty channels.

Leading online beauty platforms deploy verified reviews, transparent ingredient lists, augmented reality demonstrations, and robust loyalty programs to reassure cautious beauty shoppers. These trust-building elements bridge the gap traditionally filled by brick and mortar stores and drive commerce sales growth.

Table of Contents Introduction Search Engine Optimization (SEO) Blogging Social Media Try to

Table of Contents Introduction For creating brand awareness, explainer videos come in handy Give so

Table of Contents Introduction The power of Facebook video ad How to make your Facebook Video Ads w

Table of Contents Introduction Do’s Do consider native videos Do add a call to action Do

Table of Contents Introduction Exclusivity Piggybacking- Using Existing Users Let Users Sh

Table of Contents Introduction Build your personal brand to gain exposure Utilise content to build

Table of Contents Introduction Understanding the mobile-first index Metadata should be present on b

Table of Contents Introduction Create and optimise your GMB account Make your way to relevant onlin

Table of Contents Introduction 1) Release of Google Toolbar 2) Naming of Updates 3) Penalty for

Table of Contents Introduction 1. Utilise Guest Blogging Opportunities 2. Build Your Case Stu

SEO Revenue Generated

Leads Generated

For E-commerce Clients

Our biggest sale of the year! Redeem 25% OFF link building, brand mentions, and Digital PR. Limited Spots.

Offer valid only when you book a call.

Claim My Discount Now